will capital gains tax increase in 2021 uk

The capital gains tax on most net gains is no more than 15 percent for most people. Would the rate increase only take place from a future tax year eg.

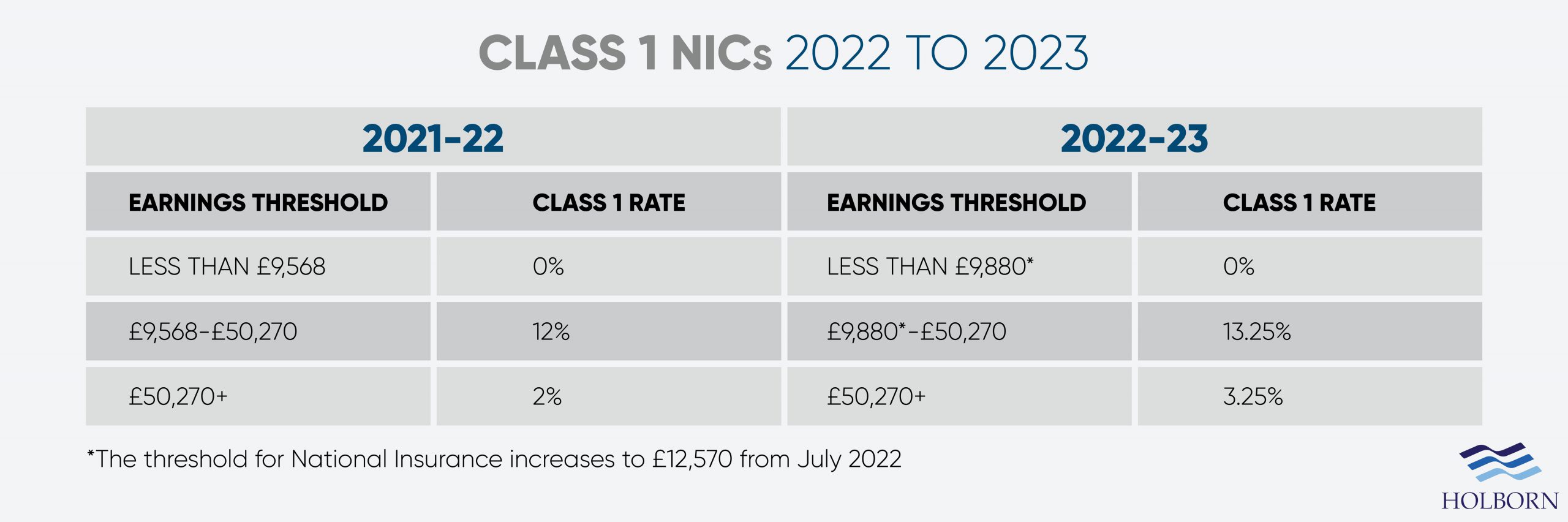

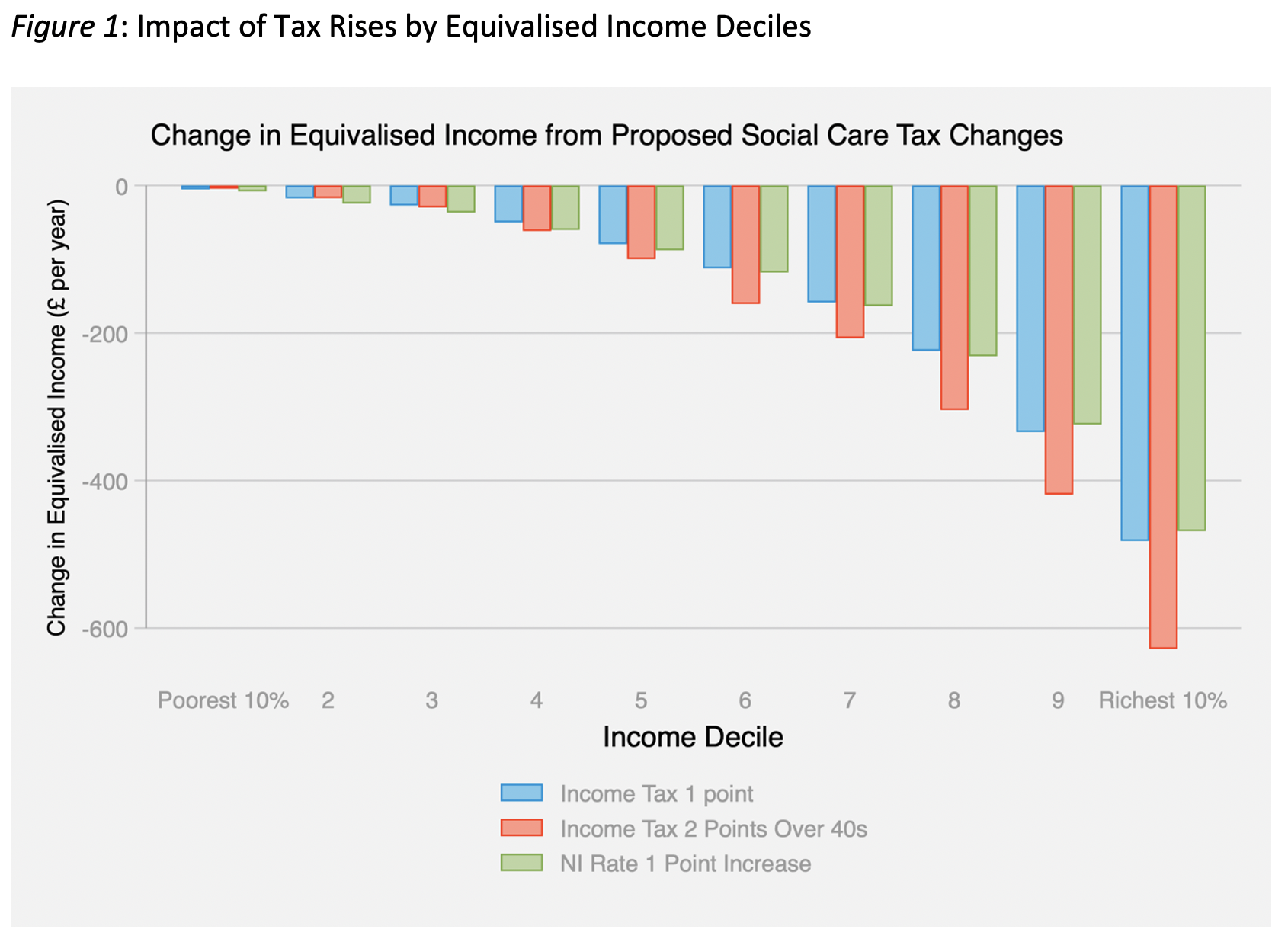

Changes To Uk Tax In 2022 Holborn Assets

The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does take place should assets be sold off before the end of this tax year.

. The increased taxes will raise almost 36 billion 496 billion over the next three years according to the government with money from the levy going directly to Britains health-. 2022 And 2021 Capital Gains Tax Rates Smartasset. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25 for a higher and additional rate taxpayers.

Or could the tax rate be retroactively applied to the 202122 tax year. Meanwhile the capital gains tax which it was thought would be increased and brought in line with income tax will not be hiked imminently. Will capital gains tax increase at Budget 2021.

Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still very possible for the budget in 2022 or in future years. UK records 44917 new cases. Strict restrictions for unvaccinated come into effect in Greece.

The chancellor also said he will not raise income tax. As of 2021 the long-term capital gains tax is typically either zero 15 or 20 percent depending upon your tax bracket. The average CGT bill is already 32000 and the tax rate could more than DOUBLE.

Tax rates increase as a property is sold. Taxes on the gain from selling other assets rise to 10 for taxpayers with basic tax rates and to 20 for taxpayers with. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four.

Tax rates on capital gains are set for 2021-22 and 2020-21. Following Uncle Sam and What It Means for UK Entrepreneurs. In 2021-22 and 2020-21 capital gains tax rates will be revised.

Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as. Although normally most tax rate changes come into effect on budget day or soon after 2021s tax reforms might need to wait. What Is The Capital Gains Tax Rate For 2021 Uk.

The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. For those on basic rate income tax the rate will depend on the size of the gain taxable income. Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Capital gains tax rates on most assets held for a year or less correspond to. By Charlie Bradley 1347 Sat May 15 2021 UPDATED.

Joe Biden says this tax increase funds a 18 trillion dollar. 2 days agoTax rates on capital gains are set for 2021-22 and 2020-21. Will capital gains tax change in 2021 uk.

Taxes united-kingdom capital-gains-tax capital-gain. How Housing Prices Have Changed Ten Years After The Real Estate Bubble Burst. Report from last year so it was good news to hear that the regime remains unchanged going into the 202122 UK tax year.

Tue Jul 27 2021 Capital Gains Tax. In the event of a property sale if the sale resulted in capital gains tax the profits will be taxed at 18 on the sale value or 28 on the income if the sale resulted in capital gains tax. The current Capital Gains Tax Uplift reduces the tax payable when an asset is.

Capital gains tax will be raised to 288 per cent by House Democrats. It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget 2021 on 3 rd March. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

Published by D. One of the areas the government is looking to increase its tax collection from is capital gains. It is unlikely to be a controversial reform to the majority of the UK population given that an increase in CGT is only estimated.

When a property is sold your taxable gains will exceed 18 of the sale price or 28 when your taxable gains exceed 28. Despite record levels of MA activity in the build-up to the Budget with Azets advising on 50 deals in just ten weeks no announcement was made and. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely.

Changes to Capital Gains Tax UK are coming for 2021. For those who pay a higher rate of income tax or a trustee or business the rate is currently 28 per cent on gains from residential property and 20 per cent on gains from other chargeable assets. RISHI SUNAK has been urged not to raise capital gains tax for the wealthy as the UK economy looks to recover from the pandemic.

In 202021 receipts from capital gains tax in the United Kingdom amounted to approximately 1061 billion British pounds an increase of approximately 800. Some tax reforms might be pushed later in the year to the fall of 2021. What the property tax rate is.

Consultations on policies that will define the UKs tax strategy for the next 10 years will start on March 23 following the budget announcements. Continued talk of a capital gains tax CGT reform in the UK has been widespread and resounding for some time. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10.

Once again no change to CGT rates was announced which actually came as no surprise. Clark Apr 29 2021. Thursday April 28 2022.

CGT is a tax on the profit when you sell an asset that has increased in value.

How Do Marginal Income Tax Rates Work And What If We Increased Them

Changes To Uk Tax In 2022 Holborn Assets

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

How Are Dividends Taxed Overview 2021 Tax Rates Examples

10 Things You Need To Know To Avoid Capital Gains Tax On Property

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Selling Stock How Capital Gains Are Taxed The Motley Fool

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Tax Advantages For Donor Advised Funds Nptrust

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

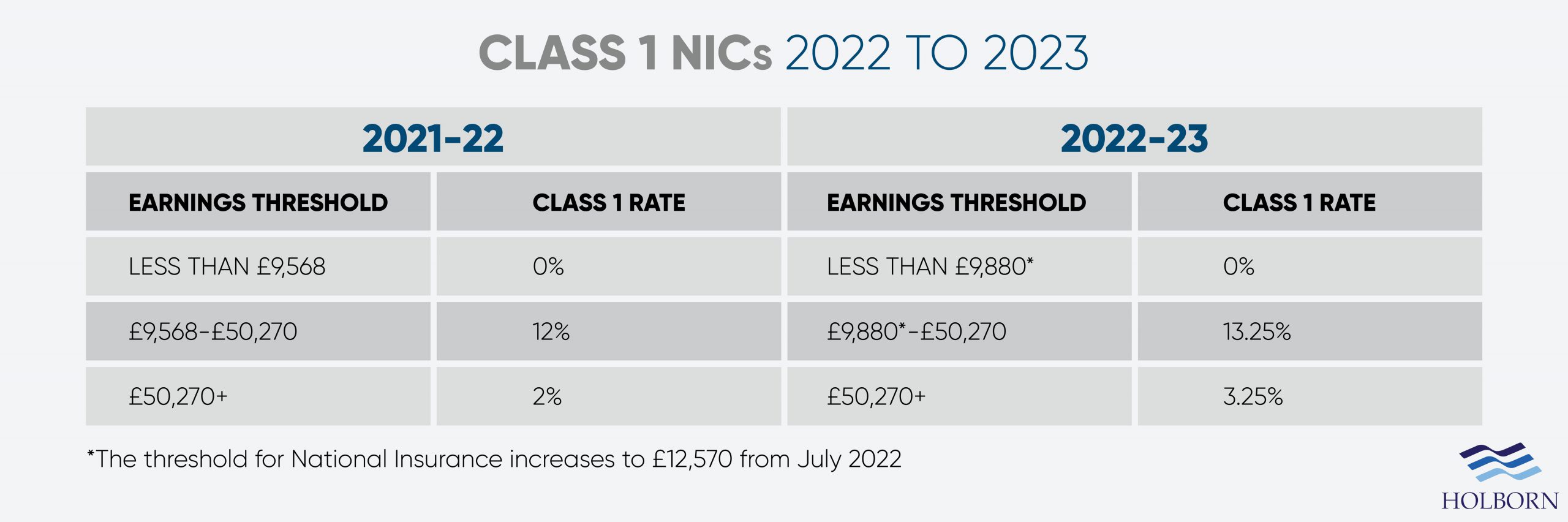

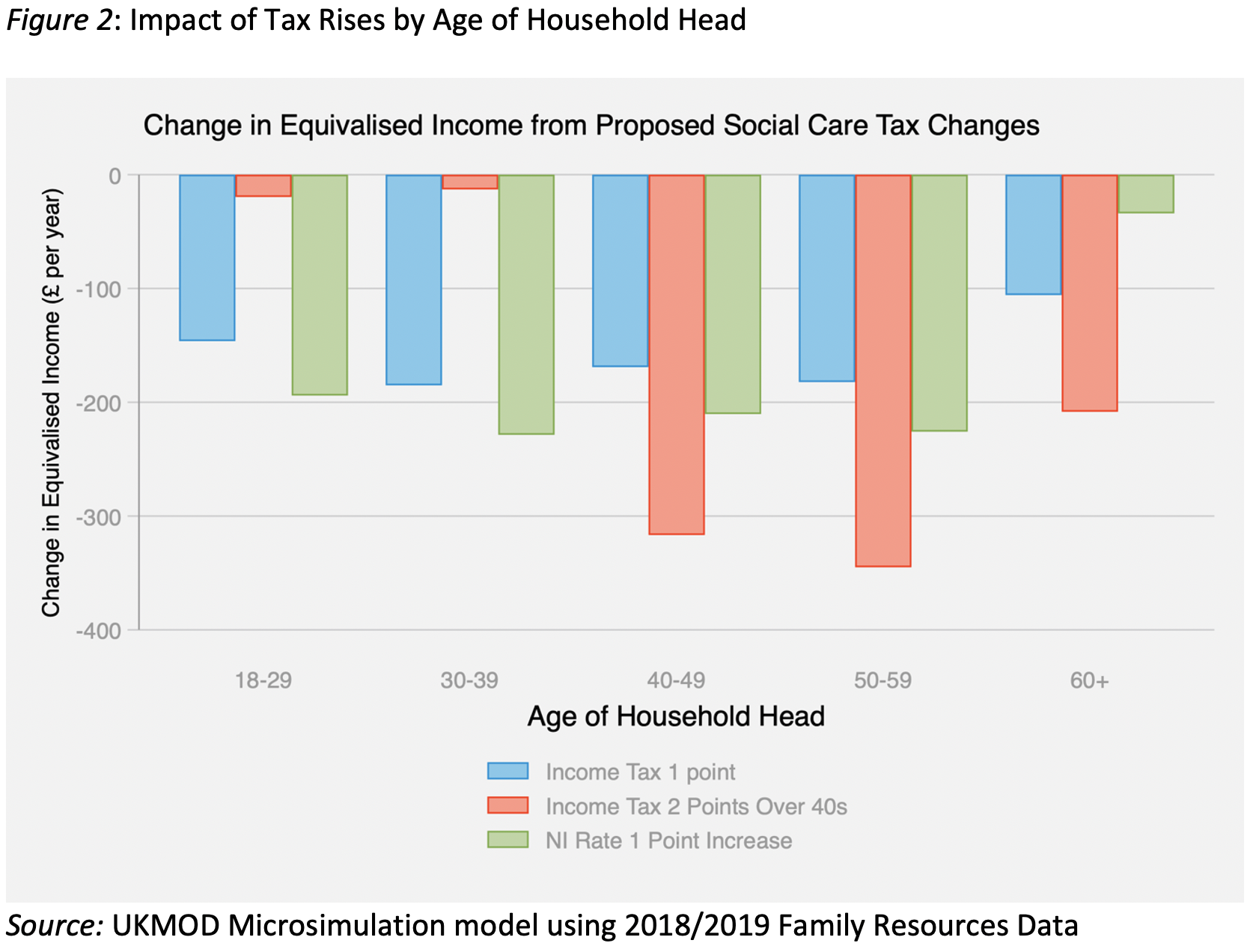

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

Capital Gains Tax Examples Low Incomes Tax Reform Group

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

Difference Between Income Tax And Capital Gains Tax Difference Between

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World